by Corey Irwin – Dec. 16, 2024 – Ultimate Classic Rock

My cmnt: The evil worldwide democrats caused incalculable harm and ruin to millions, if not billions, of people by their purposeful hype and scare tactics employed during the Covid-19 epidemic (no more of a pandemic than a bad year of the annual worldwide flu).

Despite a career spanning more than 40 years and over 14 million albums sold, the members of Tesla are not as financially comfortable as you’d expect.

In fact, guitarist Frank Hannon tells Sonic Perspectives that part of the reason his band constantly tours is that they need the money.

“We’re a lot older now and we have to tour a lot to make a living. We’re not rich. We never became millionaires,” he admitted, noting that it’s also the reason Tesla has begun releasing singles instead of albums. “We still have to pay our bills, and so it makes more sense, the philosophy of going out on tour and writing a song and while that song is fresh, putting it out and enjoying it at the time.”

Hannon went on to note that the pandemic had a heavy financial impact on his band – and they’re only slowly starting to come out of it. “We took such a huge loss being grounded for two years that we’re still barely pulling ourselves out of that hole financially,” he said.

“But that being said, the blessing to it is that when we focus on a song like [their recent single] ‘All About Love’ or [2022’s] ‘Time To Rock!’ and just focus on that and then go out and play it live while it’s hot, it just tastes better,” Hannon said. “It’s like eating a meal as soon as you get it off the stove and you put it on your plate, man — that’s when it tastes good. So, for us, we can write a song and make it happen and then hit the road and play it. And I like it better, honestly.”

Why Tesla Has Turned to Singles

While some fans may decry the move toward singles and away from albums, Hannon and his band have embraced it. “The days of taking a year off and arguing in a studio over 10 songs that aren’t gonna really get their full due [are over],” he said. “Because, really, the best way to create songs is to let them live for a while and to try ’em out at the shows and stuff, and it takes a lot of time.

“So, if you notice, a lot of bands, including ourselves, the albums, all 10 songs aren’t as good anymore because the process of spending all that time trying to make every song great, it’s just not realistic anymore,” Hannon said. “So, it works much better for us just to put all of our eggs into one song or maybe two and really make them as best as we can be and go out on the road and play ’em while they’re fresh.”

20 Rock Stars Who Went Broke

Millions of dollars sure can disappear fast.

My cmnt: Most one-time-wealthy entertainers go broke because of the Big Three: Wine, women and song. That is sex, drugs and rock-n-roll. Many of these men (almost always men) have multiple children by multiple women (we see the same thing with black athletes) which requires huge alimony and child support payments each time they move onto the next young woman. They are also so vain that they think they are chick magnets rather than cash cows. And, as in Elton John’s case and many others, they naively trust fellow travelers (i.e., people who think just like they do) with their money management. Rock stars frequently have no morals and the same can be said of their managers and the record labels that take advantage of them.

Gallery Credit: Corey Irwin

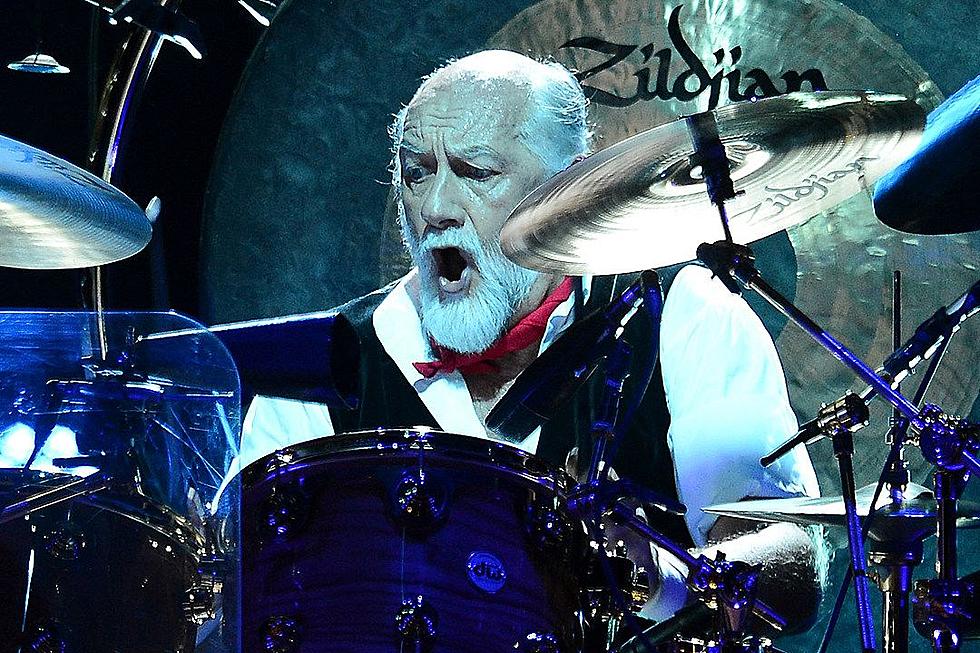

Ethan Miller, Getty Images

Mick Fleetwood

Fleetwood Mac drummer and co-founder Mick Fleetwood has joked that he’s been broke so many times that he’s lost count. “I’m like Donald Trump. I think he’s been bankrupt about seven times,” he joked to The Telegraph in 2014. Fleetwood has had many financial owes over the years; addiction was one of the major reasons. By the drummer’s estimate, he snorted more than $60 million worth of cocaine during his years of partying. Another investment was far less self-destructive but still financially damaging. “I bought a thousand-acre farm in Australia in the early 1980s. It was this whimsical decision to start a whole new life,” Fleetwood recalled Rolling Stone. “The property had about eight houses on it and a fishing lake. I cashed out about 3 million bucks and bought it. I thought it was a great place for all my friends and family, but it was also a pipe dream that literally took me to the poorhouse. I went broke.”

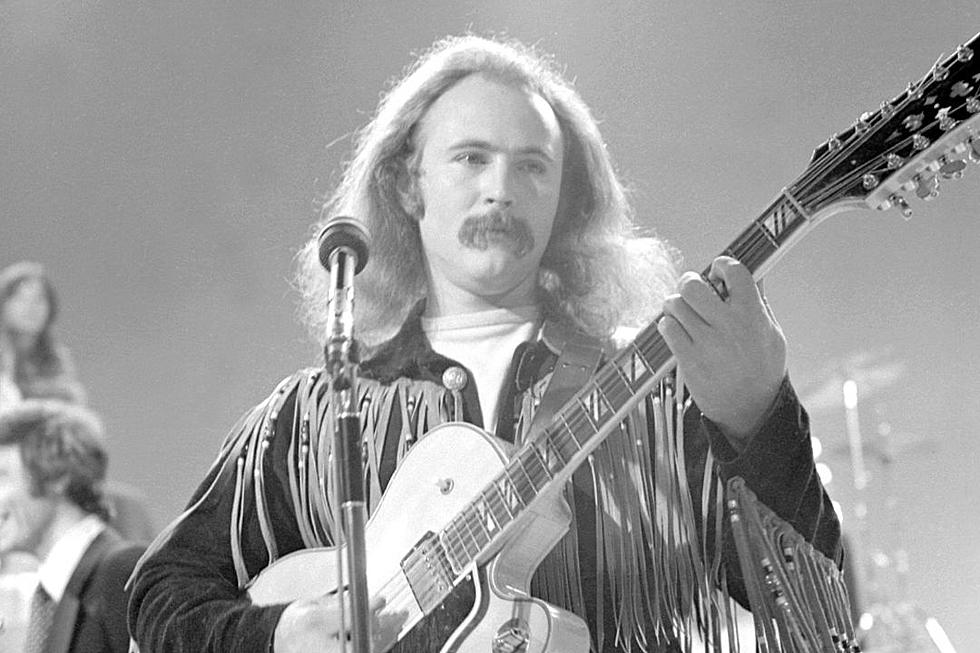

Michael Ochs Archives, Getty Images

David Crosby

Thanks to his success with the Byrds and Crosby, Stills & Nash (and later CSNY), David Crosby enjoyed great success throughout the ‘60s and ‘70s. However, with his fame came addiction, which notoriously contributed to disputes with his bandmates. Crosby squandered millions on drugs, and his solo career failed to find the commercial success of his other work. Even as the singer-songwriter’s income dried up, his addiction remained out of control. He was arrested in a Dallas nightclub in April 1982 for possessing a .45-caliber handgun and freebasing cocaine. He was sentenced to five years in jail, which, after appeals, he began serving in 1986. By that point, he’d already declared bankruptcy due to his mounting debts. He eventually cleaned up and revived his career, but this period was undoubtedly rock bottom.

Michael Putland, Getty Images

Meat Loaf

In 1977, Meat Loaf released his hugely successful album Bat Out of Hell. It would go on to sell more than 40 million copies worldwide, a number that would seemingly keep him wealthy for the rest of his life. But things are never that simple, and the singer found himself declaring bankruptcy just six years after Bat Out of Hell’s release. The reason? Lawsuits. Lots of them. Meat Loaf battled his record company over royalties for years. Even as Bat Out of Hell was becoming a massive global success, he wasn’t making a dime off its sales. He sued his label, it sued him back. Managers and other auxiliary players got involved as well, including songwriter Jim Steinman. At one point, Meat Loaf estimated he had more than 40 active lawsuits against him. He declared bankruptcy but was able to eventually find success once more with his 1993 LP Bat Out of Hell II. “It’s shameful,” the singer declared to the Los Angeles Times in 1996, referring to the way he’d been treated by his former label. “I ended up bankrupt. I lost my house and everything – even the publishing rights to my songs, which the bankruptcy court took away. But I’m not the first artist who has ever been screwed. It happens all the time.”

Michael Ochs Archive, Getty Images

Jerry Lee Lewis

Pioneering and often controversial rocker Jerry Lee Lewis had already weathered a roller coaster of a career by 1979. It was Lee who helped bring rock ‘n’ roll to mainstream white audiences thanks to such legendary tracks as “Whole Lotta Shakin’ Goin’ On” and “Great Balls of Fire.” It was Lee who outraged many when he married his 13-year-old first cousin, making him a pariah for many years. And it was Lee who staged a comeback in the late ‘60s and early ‘70s, focusing on country music. So when the IRS came calling in 1979, it represented yet another wild turn in Lewis’ life. The singer owed $274,000 in unpaid taxes, and the government seized many of his assets to cover the costs. Despite this, Lewis’ tax bill continued to balloon over the next few years. By the mid-’80s, he reportedly owed more than $2 million to the IRS, with an additional million owed in personal debts and medical expenses. Efforts to sell off property and possessions did little to help cover the costs. In 1988, Lewis filed for bankruptcy.

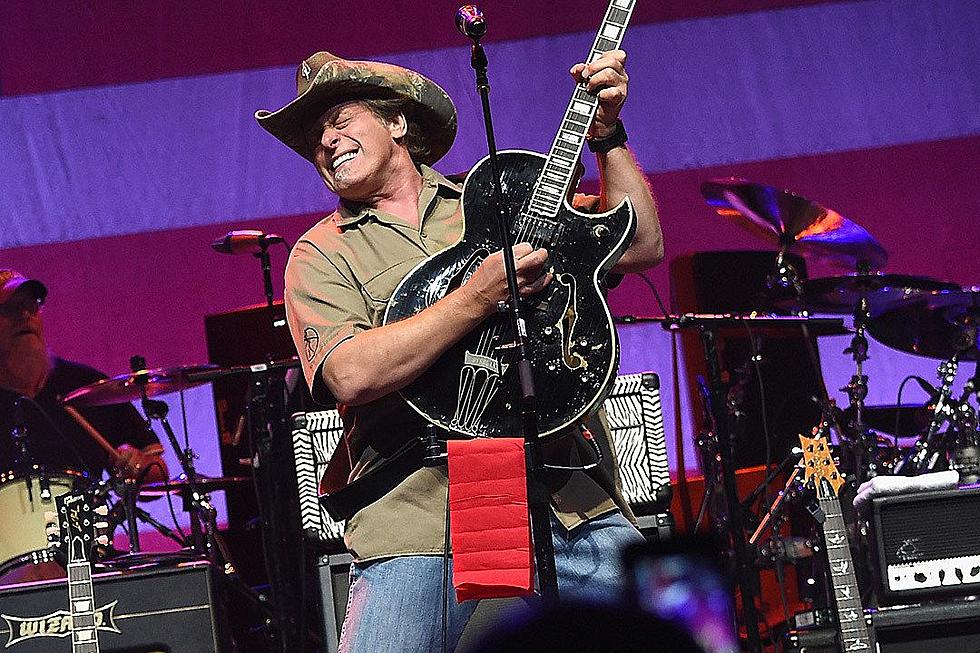

Rick Diamond, Getty Images

Ted Nugent

When one thinks of smart financial investments, mink farms don’t often come to mind. Still, that was where Ted Nugent decided to invest his money in the late ‘70s. Truth be told, the mink farm was just one of several ill-conceived business ventures for the Motor City Madman. He’d also purchased a herd of Clydesdales and a failed hotel in Flint, Michigan. He’d later blame his financial managers for the disastrous investments. Nugent declared bankruptcy in 1980 but was able to rebound financially as the decade wore on.

Don Paulsen/Michael Ochs Archives, Getty Images

Isaac Hayes

In the early ‘70s, Isaac Hayes became one of the most distinctive voices in soul music, most notably delivering the title track to the blaxploitation film Shaft. By 1974, Hayes’ record label, Stax, was going through financial problems. He was also in debt to his bank and sued the label for more than $5 million. Unable to pay, Stax agreed to let Hayes out of his recording contract, while the bank would receive his royalty payments. Hayes tried to turn things around – he started a record label and invested in the Memphis Tams, a professional basketball team in the American Basketball Association. However, his releases on his label didn’t sell and the team wasn’t able to turn a profit. Both folded and Hayes filed for bankruptcy in 1976. At the time, he was reportedly more than $6 million in debt. The singer lost his home and the rights to most of his music. Gradually, he rebuilt his career, thanks largely to a second life as an actor.

Michael Ochs Archives, Getty Images

Cyndi Lauper

Unlike many of the artists who have filed for bankruptcy, Cyndi Lauper’s came before her fame. The singer started her career in a group called Blue Angel. The band’s debut album was released in 1980 but failed to find an audience. The group broke up, and their former manager sued Lauper for $80,000. The singer filed for bankruptcy and took various jobs to cover her debts, including working in a retail store and becoming a waitress at IHOP. Lauper’s debut solo album, She’s So Unusual, came out in 1983 and became a huge success. As a result, she was able to pay off her remaining debt and forge ahead with a successful career.

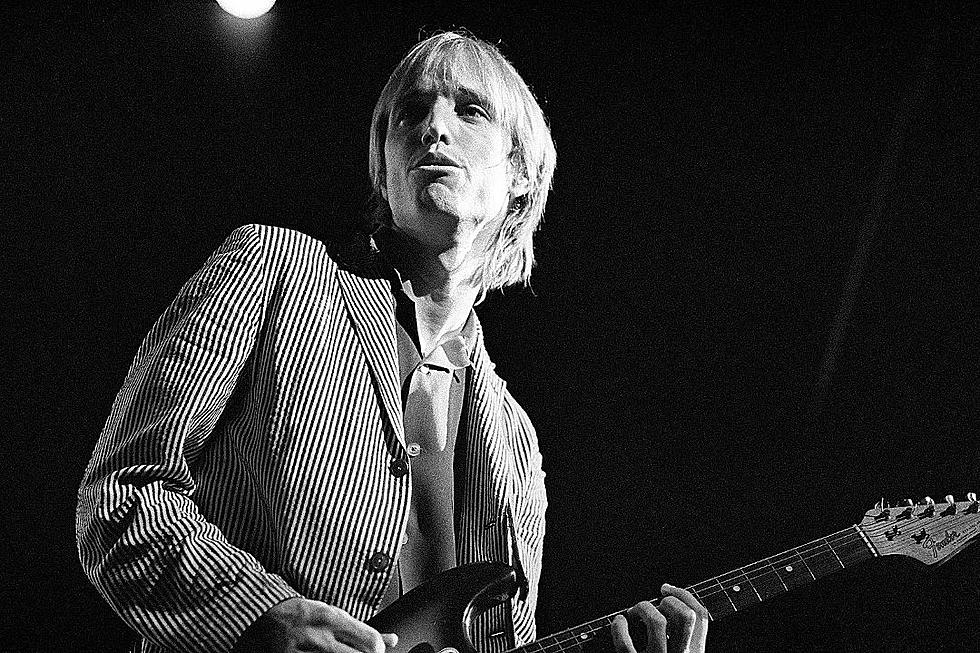

Virginia Turbett, Getty Images

Tom Petty

The story of Tom Petty’s bankruptcy is less about financial problems and more about artistic freedom. In 1979, his record label, Shelter Records, was sold to MCA. Petty was a rising star at the time with two successful albums – Tom Petty and the Heartbreakers (1976) and You’re Gonna Get It! (1978) – under his belt. As such, the singer wanted to renegotiate his contract with MCA following Shelter’s acquisition. When MCA refused, Petty took control of the matter, spending more than $500,000 from his funds to record his next album and then refused to release it. Instead, he declared bankruptcy, forcing the label to void his contract. Petty then signed a new contract with MCA, under better terms, and released Damn the Torpedoes in 1979. The album was a multiplatinum success, proving Petty’s maneuvering had been wise.

Frank Micelotta, Getty Images

Willie Nelson

Even if you’re a beloved outlaw country icon, you have to pay taxes. Apparently, Willie Nelson (or his accountants) didn’t know that. In 1990, the IRS came knocking at Nelson’s door, claiming the singer owed $32 million in back taxes. Part of the problem, Nelson claimed, was that he was advised to invest his money into tax shelters that ultimately failed. The Red-Headed Stranger was forced to sell his assets and even recorded a double album, The IRS Tapes: Who’ll Buy My Memories?, with all of the profits going to the IRS. He eventually cleared his debts by 1993.

ullstein bild, Getty Images

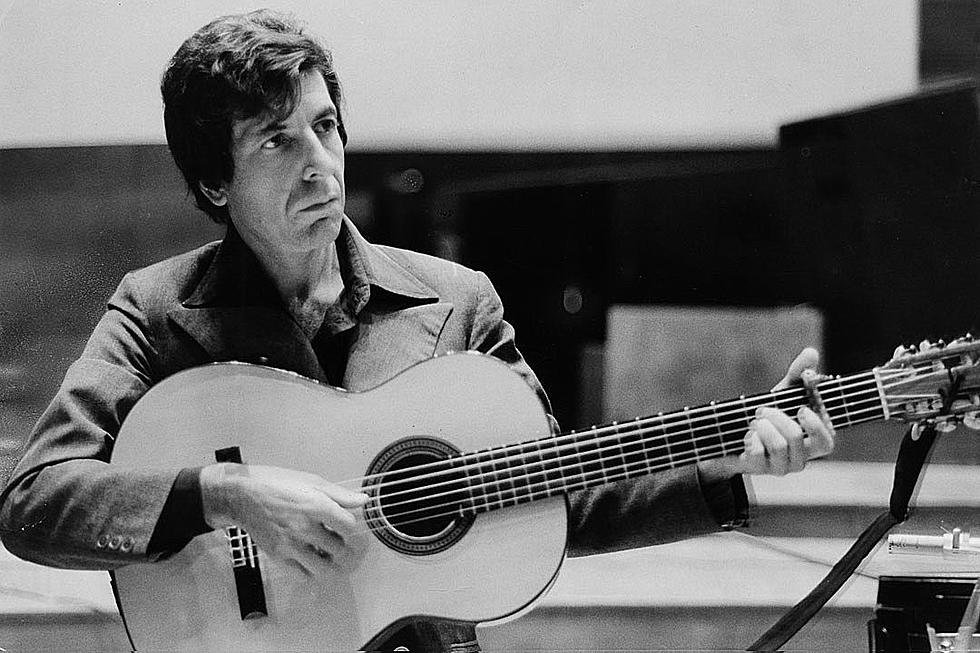

Leonard Cohen

By all accounts, Leonard Cohen had done things right. The legendary singer-songwriter enjoyed a successful and influential career, penned many timeless songs and reaped the gains of doing so. In the early 2000s he’d seemingly retired, having handed over financial decisions to someone he trusted. Then came the revelation: Kelley Lynch, Cohen’s longtime manager, had embezzled more than $5 million from the artist, while also secretly selling many of his publishing rights. Cohen sued Lynch, but the legal battle stretched for years. Facing financial hardship, Cohen decided to return to touring for the first time in 15 years. The situation proved to be a silver lining of sorts, as fans turned out in droves to see him take the stage once more. Cohen reportedly grossed $85.7 million from performances running from 2008 to 2010. The icing on the cake? The court eventually ordered Lynch to pay Cohen $9.5 million.

Nick Ut-Pool, Getty Images

Courtney Love

Despite a successful acting and recording career, as well as the assets she inherited following her husband Kurt Cobain’s death, Courtney Love has claimed to be on her last dollar multiple times. According to the Hole leader, various managers, lawyers and banks have swindled her out of a fortune. She’s claimed they took advantage of her when she was a mourning widow, or in other situations when she was too high to make sound financial decisions. Love estimates she lost more than $500 million in money and assets. At one point she and her daughter, Frances Bean Cobain, moved in with Love’s parents while they tried to get a handle on her ongoing money problems. In 2010, Love borrowed $2.75 million from Frances’ trust fund to help pay off debts. At one point, Love insisted she was close to homelessness, though the accuracy of that claim has been disputed.

Angela Deane-Drummond/Evening Standard/Hulton Archive, Getty Images

Marvin Gaye

Some of Marvin Gaye’s most timeless music was romantic. Unfortunately, the singer’s love life proved to be damaging. In 1963, Gaye married Anna Gordy, elder sister of Motown founder Berry Gordy. Marvin and Anna’s marriage would turn toxic, with both accused of abuse and adultery on multiple occasions. The couple separated in 1973 but weren’t officially divorced until 1977. Gaye was ordered to pay $600,000 to his former wife but fell behind on alimony payments. The singer reportedly squandered money on a lavish lifestyle, spending on everything from drugs to cars and property. His divorce also coincided with a downturn in Gaye’s commercial popularity, adding further weight to the singer’s suddenly mounting financial struggles. Gaye filed for bankruptcy and agreed to give Gordy the royalties from his 1978 album Here, My Dear, but its sales were poor. The singer eventually saw a career resurgence with 1982’s Midnight Love. Despite this, Gaye reportedly still owed Gordy close to $300,000 when he died in 1984.

After an argument between father and son escalated into a physical fight on the morning of April 1, 1984, Alberta Gay was trying to calm her son in his bedroom when Marvin Sr. took a revolver given to him by Marvin Jr. and shot him three times in his chest, the first round hitting his heart.

Ebet Roberts/Redferns, Getty Images

Billy Joel

Billy Joel’s first wife, Elizabeth Weber Small, also served as his manager. When the couple divorced in 1982, Joel opted to keep his business affairs in the family, hiring his brother-in-law, Frank Weber, as Elizabeth’s replacement. The decision proved unwise. Weber siphoned millions from Joel’s funds, while also taking bank loans in Joel’s name and making risky investments. After an audit revealed Weber’s deceitful bookkeeping, Joel fired the manager and sued him for $90 million – $30 million to cover his losses and another $60 in damages. Even though Joel won the case, he received only a pittance from Weber. The financial losses, coupled with legal costs, left Joel on the verge of bankruptcy. But the singer and songwriter was still very popular at the time of his money problems. Through successful touring, as well as 1993’s multiplatinum album River of Dreams, Joel was able to quickly turn around his fortunes.

———————————————————————————–

Kevin Winter, Getty Images

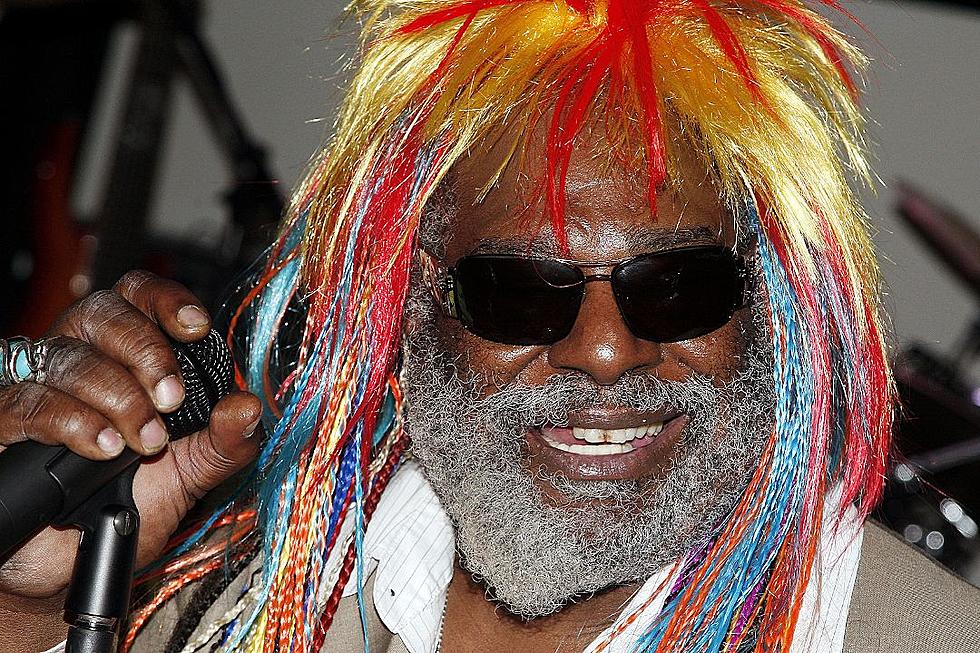

George Clinton

After coming to fame in the ‘60s and ‘70s, funk legend George Clinton suffered through some serious financial turmoil in the ‘80s. Much of the problem stemmed from his discourse with Bridgeport Music, a music publishing company that acquired the rights to many of Clinton’s songs. The issues were compounded when Clinton filed for bankruptcy in 1985 but failed to disclose the songs he’d written between 1976-83 as a potential source of future income. The Parliament-Funkadelic frontman claimed that the bankruptcy filing was fraudulent and that his signature had been forged. In 2001, a judge ruled against Clinton, asserting that Bridgeport Music owned the singer’s copyrights, valued at over $100 million. The singer continues to battle for his copyrights, but the legal battles have come at a cost. In 2010, Clinton sold off the rights to some of his other songs to help pay for his legal fee debts.

———————————————————-

Dee met his wife Suzette when she was 15 and he was 21 after she snuck into a Long Island nightclub. They married in 1981, have been together since and have four kids. 6.Mar 15, 2024

Snider has been married to his wife Suzette, a costume designer, since 1981. They have four children, Jesse Blaze Snider (born September 19, 1982), Shane Royal Snider (born February 29, 1988), Cody Blue Snider (born December 7, 1989), and Cheyenne Jean Snider (born October 31, 1996) who was in the band They All Float.

Dee Snider

Twisted Sister frontman Dee Snider has repeatedly admitted he was dead broke in the ‘90s, the result of a bad contract signed by the band and grunge’s effects on glam metal acts of the ‘80s. “Here I am in ’95 leaving a thrift store because I don’t want people saying, ‘What are you doing here?’” Snider recalled to Fox News, remembering how he and his family had to pinch pennies to survive. “I would always look at the other stars who crashed and burned and say, ‘That will never be me. I don’t drink, I don’t get high, I don’t have a manager that rips me off. I don’t have anyone that can put one over me,’ and I didn’t. I did it to myself.” Snider survived the ‘90s and worked his way back to prominence, hosting a radio show, penning a hugely successful Christmas song and even appearing on Broadway.

Below: from the Jew or Not Jew website

——————————————————————————–

Central Press, Getty Images

Sly Stone

The financial woes of funk legend Sly Stone are well-documented and extremely complicated. Among the legend’s many money problems: an IRS lien on his house that lasted for decades, a drug problem estimated to have cost millions of dollars to maintain and multiple instances where he made the ill-advised decision to sell portions of his publishing rights to help cover debts. Stone also engaged in a drawn-out legal battle with his former manager who he alleged siphoned millions in royalties over more than 20 years. Because of his terrible financial state, Stone became homeless, living out of a van in Los Angeles in 2011. Four years later, he won a $5 million lawsuit against his former manager.

Tom Hanley, Getty Images

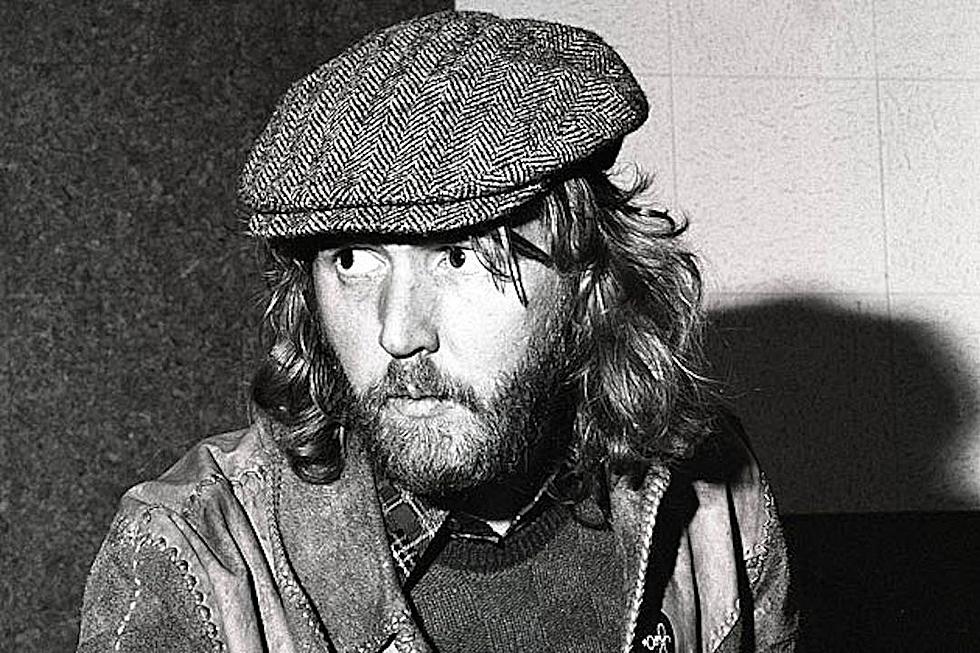

Harry Nilsson

In the late ‘60s and early ‘70s, Harry Nilsson was one of the most talked-about musicians on the planet. He appeared on the cover of Time and rubbed shoulders with the Beatles (who were fans). And though his albums were never chart-toppers, he earned critical praise, won two Grammy awards and signed a $5 million record deal before turning 30. However, Nilsson’s career hit the skids in the ‘80s and things got even worse in 1991 when he discovered that his business manager, Cindy Sims, had embezzled millions of dollars. “We went to bed one night a financially secure family of eight and woke up the next morning with $300 in our checking account,” Nilsson wrote in a letter to the court. Sims, it turned out, had been secretly removing foreclosure notices from Nilsson’s home in an effort to hide the grave financial situation the singer and songwriter was in. Nilsson was forced to file for bankruptcy. He died of heart failure in 1994.

Scott Gries/NBAE/ImageDirect, Getty Images

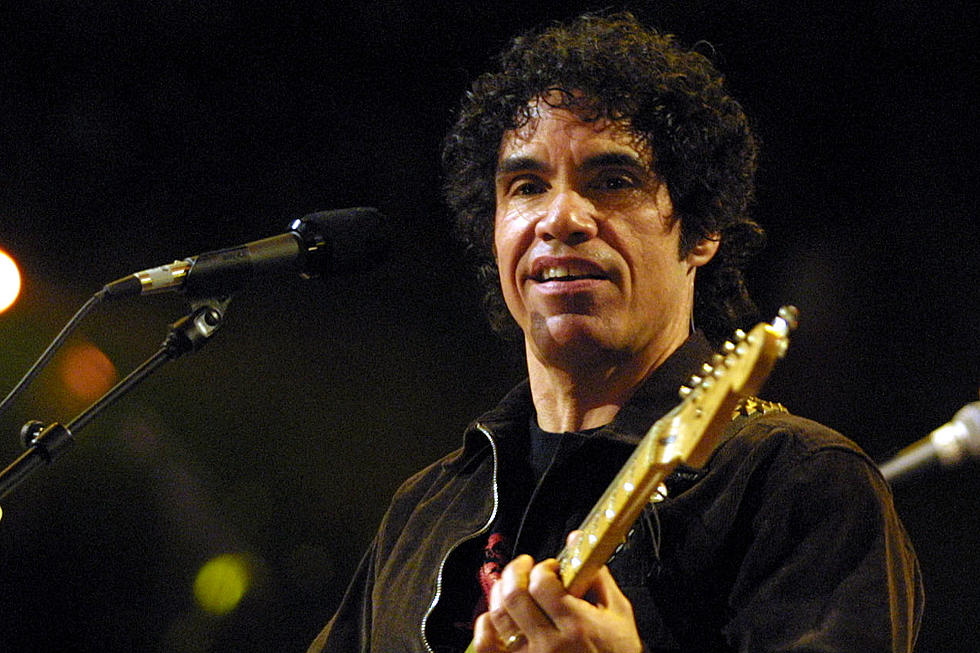

John Oates

In 1987, after selling more than 80 million records worldwide as one-half of Hall & Oates, John Oates was given some sobering news: He was broke. The artist had enjoyed a lavish lifestyle, with purchases including a private plane, four homes and several antique cars. These things came with a price, and Oates admitted his own success blinded him from realizing he was living so far above his means. He laid part of the blame on manager Tommy Mottola and lawyer Allen Grubman, the men he’d trusted to keep such things in check. “I just wish they’d warned us that the high life we were living would have financial consequences,” Oates wrote in his 2017 memoir. “We weren’t cheated; we were seduced.” By Oates’ account, he was so far in debt that the $50 in his wallet at the time was his only liquid asset. Fortunately, he was able to soon right the ship, as Hall & Oates recovered millions of dollars in unpaid royalties.

Guy Clark, Getty Images

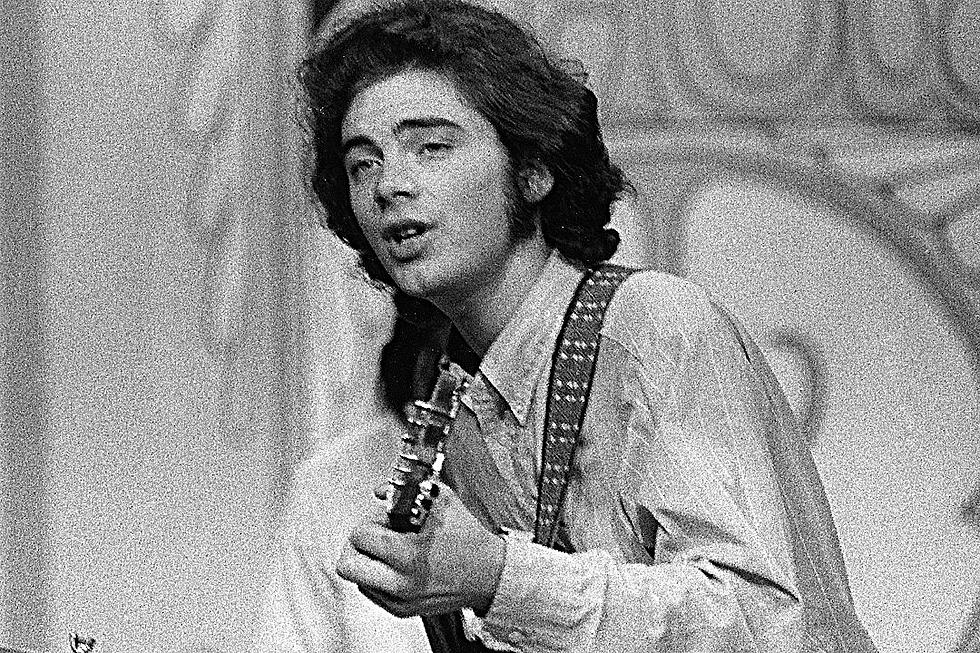

Roky Erikson

Roky Erickson was the frontman and co-founder of the 13th Floor Elevators. The band’s psychedelic sound helped them come to prominence in the mid-’60s, with the 1966 single “You’re Gonna Miss Me” representing a commercial peak. In 1969, Erickson was arrested for possession of a single marijuana joint. He faced a possible 10-year sentence, but the singer, who had been diagnosed with paranoid schizophrenia, pleaded not guilty by reason of insanity. He was sent to a psychiatric hospital where he received electro-shock therapy and Thorazine treatments. During this time, Erickson’s finances were completely mismanaged. By the time he was released from custody in 1972, he was broke. He’d go on to form a new band, Roky Erickson and the Aliens, and later disappeared from the public eye for most of the ‘80s. Renewed interest in his music and personal story helped Erikson enjoy a revival in the mid-’90s that lasted through his death in 2019.

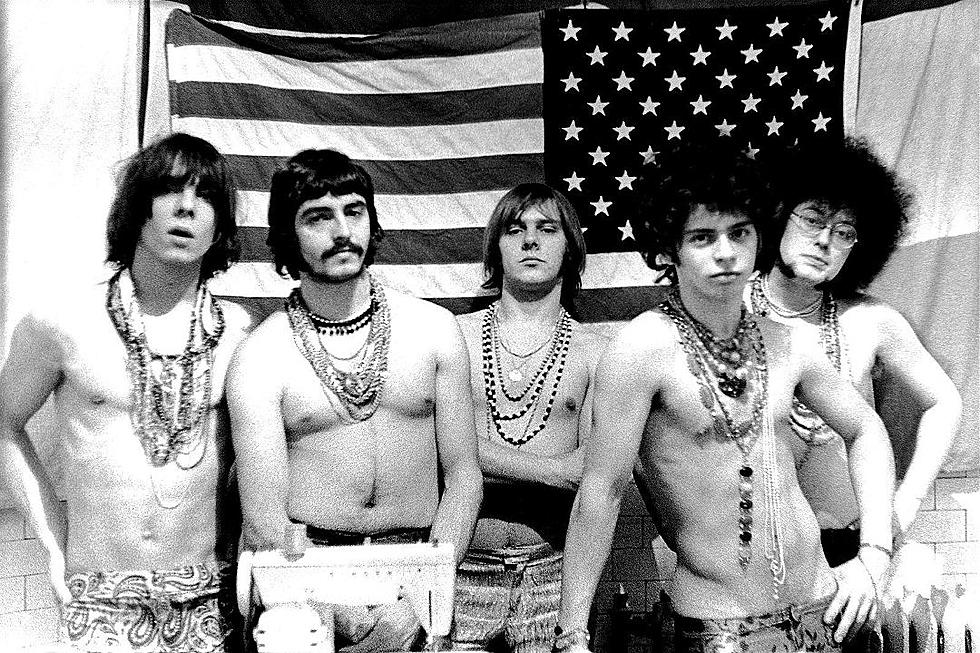

Leni Sinclair, Getty Images (Put some shirts on guys. This photo alone would kill any rock band.)

MC5

Detroit legends MC5 were known for their anti-establishment ethos, coupled with an electric garage rock sound. The group was hugely influential but not commercially successful. Neither of their studio albums – Back in the USA (1970) and High Time (1971) – sold well, leading the band to be dropped by their label. Somewhere around the same time, the group filed for bankruptcy. MC5 were reportedly indebted to promoters and agents for more than $80,000, with drug habits among the band’s members accruing further debt. The group disbanded in 1972 and didn’t reunite until the ‘90s.