A (well-to-do) reader offers a thoughtful take on problems that go past inflation…

Alex Berenson – Nov 06, 2025 – his Substack (i’m a subscriber)

By most measures, the American economy is in excellent shape.

America’s economic output is now about $30 trillion — $85,000 per person, far more than other big countries. The United States still accounts for one-quarter of the world’s total output, the same share as 35 years ago. China’s rise has come mostly at the expense of Europe and Japan, while American technology giants lead the world.

The recent numbers are good too. Unemployment is just 4 percent, while the United States grew almost 3 percent last year, even faster this spring. Stocks are up.

—

(The good news, and the bad news too. For pennies a day. Join the UT team!)

—

And yet.

And yet many, if not most, average Americans feel squeezed. The numbers may look good, but the economy doesn’t feel good to them. Why? Inflation is one obvious reason, as I wrote today. Raging health-care costs are another.

But the problems run even deeper. And after today’s piece I got a reader email that I think captures two more of them — about the rise of corporate monopolies and the growing imbalance between corporate profits and wages — smartly and concisely.

It’s too good not to share, so I’m sharing it. Enjoy.

—

[Edited only for minor copy fixes.]

Hi Alex,

Thanks for what you do. I’ve been following you since COVID days and really appreciate your work.

I’d like to add two points to your discussion on inflation. Before I do, as important context, I’m a management consultant. My clients are Fortune 500s, and I’m a ‘1%’ income earner.

1) We need to have a serious national discussion on market concentration and monopoly power among our businesses. Nearly every industry – including staples and discretionary sectors – have gone through wave after wave of consolidation.

Today in many industries there is an illusion of competition which is helping to keep prices stubbornly high while margins / profits as a share of GDP [gross domestic product] are near historic highs. And don’t get me wrong, I’m a red-blooded capitalist, but today’s market structures are more crony capitalism than they are true capitalism.

—

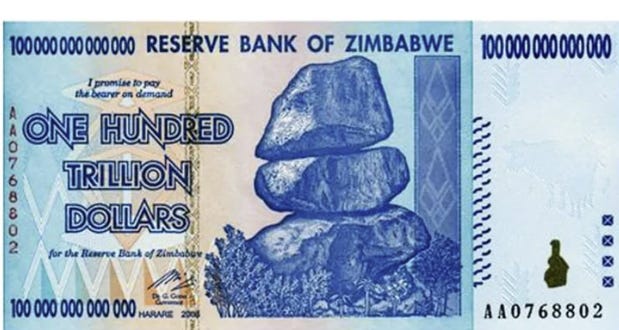

(It could be worse…)

—

2) The only way to address the problems you’re outlining is pain for the economy. Some combination of asset prices falling, profit margins falling, and more price increases is inevitable. We can’t make home prices more affordable if prices don’t fall (lower interest rates aren’t enough).

The American economy holistically needs to earn more income1, which inevitably means we need to increase income earned by the bottom 50 percent, which means reshoring which means cost of goods rise or margins fall. We also can’t deficit spend our way out of this problem … that just kicks the can down the road.

In my view that means things will get worse before they get better. It’s likely that more Mamdanis will surface offering solutions that are redistributive in nature.

—

(Redistribute your income to Unreported Truths! Hey, it beats Zohran Kwame…)

—

This is a slightly awkward phrasing, but I think his meaning is ultimately clear – wage-earners need to take home a greater share of income – so I decided to leave it as is.