Henry J. Cordes Omaha World-Herald – Aug 10, 2024

My cmnt: I post this here because I just got (another!) letter from my carrier that my homeowner’s insurance is going up again. It has doubled!! since Biden and the democrats stole the 2020 election. I’m convinced that the skyrocketing rates have something to do with Covid (if you want the details email me thru the Contact page), the democrats and Bidenomics/BidenFlation. Of course rates have to go up when the democrats double the cost of building supplies. This time instead of raising the price, just like with food, they just reduce the portions. My latest letter leaves the cost the same they just greatly increased the deductible I must pay when there is a claim.

My cmnt: Now, aside from how the democrats always make everything worse, there is another reason. Technically west of the Missouri River is called the High Plains, not the Midwest. All of the states (North & South Dakota, Nebr, Kansas, Okie, & Texas) were more-or-less treeless plains covered in grass and buffalo. People like shade and so they plant trees. Tornadoes and high winds don’t like trees and shingles. It’s the same reason people live on the east coast with high winds and hurricanes.

Over the past year, Nebraska saw the nation’s second-highest increase in homeowners’ insurance rates, an analysis found.

And that’s in a state that already tends to have among the highest home insurance rates in the country, largely driven by the propensity for the state to get socked by hail, tornadoes and other damaging severe weather.

Rep. Mike Flood on Friday cited the analysis in proclaiming Nebraska is facing a home insurance crisis. He said he plans to pull together a state working group to see what can be done about it this fall.

“In the last couple of weeks, severe weather events have once again ripped through our communities, leaving damage that will only put more upward pressure on the cost of home insurance,” Flood said. “We need to tackle this problem and do so quickly.”

Omaha insurance agent Pat Lemmers said he’s not surprised that a study would show such a big rate spike in the past year. He said some insurance companies recently have made “monster” increases in their Nebraska rates, largely driven by the high storm-related losses they’ve had to cover in recent years.

“The insurance companies have tried to keep the prices low, and about 18 months ago they finally threw the towel in and said, ‘We can’t lose any more money,’” Lemmers said. “It was a domino effect.”

The analysis by Bankrate that Flood cited found home insurance costs in Nebraska were up 61% over the previous 13 months as of February. That was second only to a 63% increase in Louisiana.

A number of studies have generally indicated Nebraska has some of the highest rates in the country overall. A Bankrate analysis this month found Nebraska now has the nation’s highest rates for a $300,000 home, just ahead of Florida.

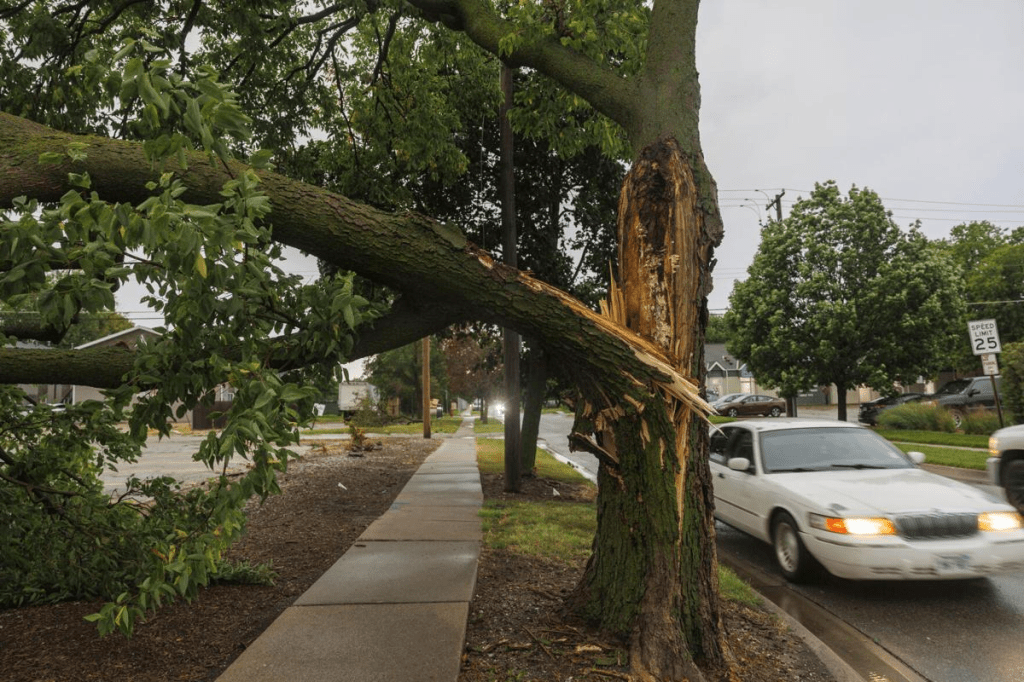

A tree is seen down near South 18th and M streets after an afternoon storm passed through Lincoln on July 31.JUSTIN WAN, Journal Star

The more recent study put the annual cost of insuring such a home in Nebraska at $5,655. That was a whopping $3,385 above the national average premium. Iowa’s average premium on such a home was far below Nebraska’s at $2,093, ranking 20th nationally.

A July analysis by Insurance.com put Nebraska’s rates third highest in the country, behind Oklahoma and Kansas. What those three states have in common is a propensity for tornadoes and other destructive storms, the analysis said.

Lemmers, an independent agent who works with multiple companies, said hail is the biggest driver in recent Nebraska home insurance claims and rate spikes. He’s not sure if the recent destructive storms like the July 31 windstorm and the April tornado outbreak will lead to further increases in rates given the big increases already handed down recently.

He said insurance companies have also taken other actions in the face of their losses in recent years. He said he knows of some sizable companies that have completely stopped taking on new business in Nebraska, mainly because they can’t afford the additional reserves they would need to accrue to take on the additional policies.

He said some companies are also now excluding coverage of damage to homes that is only cosmetic in nature, such as hail dings to downspouts or window frames.

Flood, the Norfolk businessman who represents Nebraska’s 1st District in Congress, called the combination of rising home insurance costs and escalating property taxes “a one-two punch” that makes it more difficult for Nebraskans to afford their homes.

He said the working group he plans to put together will include insurance industry leaders, home builders, and other stakeholders.

He said the goal will be to “support homeowners in Nebraska and across the country who are struggling to afford the cost of staying in their homes.”