By Michael Hiltzik Business Columnist – Apr 3, 2023 – LA Times

My cmnt: Two of the most universally popular and successful creations of the federal government in the 20th century are the national parks and a national pension called social security. By ensuring that (almost) all working people and their employers contribute to their own, guaranteed pension fund (at a combined rate of about 13%) and placing this money into very stable treasury bills we are able to provide a national pension proportionately funded by the very people who will use it when they retire.

My cmnt: Please note the charts and explanations below to see federal revenues vs federal spending. **

My cmnt: Now to be entirely fair and accurate this “trust fund” exists only on paper as our national debt standing now at $34 Trillion (an impossible number to grasp) shows that we owe way more than the $2.8 Trillion allegedly sitting somewhere in a big pile of money. Social Security has been a pay-as-you-go system for almost ever since this fund is actually just lumped in with the rest of the federal budget.

My cmnt: So what the trustees report is really saying is that at some date, 2033 now, the fund will put out more than goes into it – IF nothing changes between then and now. This writer offers a very simple and actuarially sound method to keep this trust fund solvent well off into the future. But remember this only really shows up on paper and as funny-money. If we continue deficit spending and borrowing forever social security, like everything else, will eventually be affected.

My cmnt: I want to also point out that much of the revenue that supports large welfare states like Britain, Canada, Denmark and Norway comes from natural resources revenue such as and mainly oil. So when Biden and the democrats stop domestic oil production they also hurt our economy, tax revenue and just about everything else.

My cmnt: We currently borrow to pay for 23+% of the federal budget. The real trick here is how to raise taxes that much without destroying the economy or how to cut the budget that much to live within our means. Since neither of these is ever likely to work or to happen President Trump, President Reagan and other Republicans have said the only feasible answer is to continue to grow the economy in a stable, non-inflationary manner and produce as much domestic oil as we can. Faux-president Biden and company see to it that this never happens under their watch as it appears the democrats real goal is to destroy America and replace our prosperous middle-class with abject poverty as seen in their beloved communist countries.

’Tis the season for hand-wringing over the fiscal condition of Social Security.

This annual event is invariably triggered by the release of the program’s trustees report, which occurred Friday. As is typical, the release inspired reams of journalistic and political alarmism about what will happen when the program’s reserves (that is, its two trust funds) are exhausted.

The trustees currently project that will happen in 2033. At that point, they say, current revenues from the payroll tax would be sufficient to cover 80% of currently scheduled benefits. That’s a year earlier than the projections in last year’s trustees report.

This sounded dire, superficially, and major news sources piled on. “Social Security funding crisis will arrive in 2033, U.S. projects,” the Washington Post reported. The Committee for a Responsible Federal Budget, which is an offspring of the late private equity billionaire and Social Security foe Peter G. Peterson, declared in the wake of the trustees’ report that “Social Security is 11 years from insolvency.”

The annual report lent urgency to a raft of proposals to “fix” Social Security. Most such proposals amount to benefit cuts; that would be the result of steps such as raising the retirement age, reducing payments to wealthier recipients, gutting cost-of-living increases and recalculating lifetime earnings.

Some even advocate starting to cut benefits now, supposedly because the resulting strain would be easier on retirees’ household budgets if it’s spread over a decade rather than coming all at once. This theme was hammered home by the CRFB , which asserted that “time is running out to save Social Security.” Acting sooner rather than later, the committee said, “gives workers time to plan and adjust.”

So it behooves us to take a closer look at what the trustees actually said, at least so we have a better sense of the implications of any “reform” proposals. That’s especially true because the would-be reformers generally skate over the one sure-fire method of providing all the revenues the system needs to fully cover its obligations: Raise the Social Security tax not on ordinary workers, but wealthier Americans who have been getting a free pass on their full obligations to the system.

First, let’s examine the implications of the one-year change in the year of projected trust fund exhaustion. As Kathleen Romig, the Social Security expert at the Center on Budget and Policy Priorities, pointed out on Twitter: “A year’s worth of fluctuation in the reserve depletion date is not a cause for alarm — or celebration, if it goes the other way!”

For more than a decade, Romig observes, “every Trustees’ Report has estimated a reserve depletion date between 2033 and 2035.” Most of the change this year happened not because the program’s “finances continue to deterioriate,” as the CRFB claims, but because of technical factors, Romig states.

These include a change in the program’s projection methodology and an update to its valuation period. The latter is the 75-year span over which the system’s actuaries calculate its finances. Every year, that period advances by a year, so, a low-deficit year drops away and a high-deficit year is added. That increases the 75-year gap,” Romig writes, “even if the shortfall in each individual year of the projection stays the same.”

Big changes come from the system’s estimates of inflation, productivity, birth rates and other demographic factors. The trustees are projecting higher inflation, lower production output and lower birth rates over the next decade and the 65 years beyond. But those estimates are based partially on snapshots of current conditions, so they’re obviously conjectural.

The overwrought concerns about Social Security’s fiscal condition never ceases to produce rococo proposals for reform. A persistent idea is to raise the retirement age. I deconstructed this plan in February, when the CRFB advanced it in the guise of promoting “productive aging” by removing “work and savings disincentives in the current program.” (Translation from the CRFB’s gibberish: “Make working people work longer.”)

As I wrote then, proposals to raise the retirement age are based on the assumption that older workers would continue to work, perhaps until they drop dead, if not for what the CRFB called the “mixed retirement signals that often draw them into early retirement and treat retirement itself as a binary choice.”

That implies that workers are almost duped into filing for Social Security, when they would be so much happier staying on the job.

These proposals, however, never take into account the differences in life expectancies arising from ethnic, income and educational factors. Put simply, they would disproportionately penalize Black, lower-income and less-educated workers, as well as those whose working lives were spent in physically demanding jobs. These proposals boil down to rich desk-jockeys telling others to just suck it up.

Another perennial is to divert Social Security revenues into ostensibly more rewarding investments than the Treasury securities in which the program is legally bound to park its reserves. The trust funds, which hold those reserves, currently amount to more than $2.8 trillion.

The latest iteration of this idea is being formulated by a group of senators led by Bill Cassidy (R-La.) and Angus King (I-Maine).

Details of the Cassidy-King proposal are scanty, but what’s known is that it would involve creating a “sovereign wealth fund” of some $1.5 trillion in borrowed funds to invest in the stock market, real estate and other investments currently closed to the system.

The theory is that, over time, these investments would produce enough income to pay back the borrowings with interest and contribute what’s left over to the Social Security reserve.

Fans of Social Security’s investing in the stock market rely on the rule of thumb that over the long term the market yields an annual average of more than 8% over inflation. Over the last century, the return of the benchmark Standard & Poor’s 500 index was an annualized 7.51%, while the system’s most recent purchases (in June 2022) were of Treasuries yielding an average 3%.

That makes the proposal seem simple. In the real world, it’s anything but. It’s too easy to be fooled into “believing in the fantasy of a stock market ‘free lunch,’” observes the National Committee to Preserve Social Security and Medicare.

To begin with, as I’ve noted in the past, the actual yield of the stock market over periods of less than a century is highly variable. The inflation-adjusted compound annual growth rate of the S&P 500 for successive 45-year periods has ranged from 4.57% (in 1964-2008) to 8.27% (in 1975-2019).

Then there are the political implications of investing government funds in corporate equities. At a hearing in 1937, Sen. Arthur Vandenberg (R-Mich.) asked Arthur Altmeyer, a Social Security staff member and future commissioner, how he proposed to invest a reserve fund that was then expected to grow to $47 billion.

“You could invest it in U.S. Steel and some of the large corporations,” Altmeyer suggested.

“He just threw up his hands in holy horror,” Altmeyer recalled years later. “That would be socialism!” Vandenberg exclaimed.

In today’s fraught political environment, the prospect is high that stock market investments would be monitored and questioned by congressional busybodies.

Are the investment managers applying “ESG” considerations to their choices? (Those are environmental, social and governance standards that some investment fiduciaries utilize to judge the prudence of investments.) Red-state politicians are so exercised over the very thought that this is happening that they’ve boycotted management firms that use them — at the potential cost of hundreds of millions of dollars in income.

The truth is that elaborate schemes to reach for yield are totally unnecessary, as almost all Social Security experts know. What’s needed to close the gap between current revenues and annual benefit payouts is simply to eliminate the cap on the payroll tax and apply it to investment income.

This year, the tax is capped at 12.4% of all wage income up to a maximum of $160,200, with the levy shared equally by employers and employees. Investment income such as capital gains and dividends are entirely exempted. That’s a little-appreciated dodge enjoyed by the 1%, who on average receive about half their annual income from those sources.

To see how this works, consider that the maximum payroll tax this year (counting both the employer and employee shares) is $19,864. For someone in the 1% collecting, say, $600,000 in wage income, that tax amounts not to 12.4% of income, but only 3.3%. If that $600,000 was only half the taxpayer’s income, with the rest coming from investments, his or her effective tax rate would be only 1.66%.

That points to the most effective means of shoring up Social Security. Removing the wage cap and adding a 6.2% tax on investment income would eliminate the entire projected revenue shortfall, according to the American Academy of Actuaries.

Indeed, those changes would provide enough headroom to accommodate a couple of long-overdue improvements, specifically raising the surviving spousal benefit to 75% of the deceased spouse’s benefit from the current 50%, and counting as covered earnings up to five years of childcare, which currently are counted as zero earnings.

There’s a reason why such an obvious solution gets short shrift from policymakers: It would hit the patrons of federal lawmakers where they live. It’s much easier to pile the burdens of retirement funding onto middle- and low-income earners. They don’t have the political megaphones of the affluent.

What’s most offensive about the reform proposals swirling around in Washington is that they assume that America’s working class can be easily gulled into thinking these solutions will be painless. Raise the retirement age over time — why, everyone is living longer, so what’s wrong with that? Invest Social Security in the stock market? The riches will just flow in. Start cutting benefits now — who would really notice?

Let’s not overlook that the promoters of all these proposals promise that they would only affect young workers, not those nearing retirement or already on a pension. Where’s the justice in that?

There’s only one rationale for any benefit cuts in Social Security. It’s to build a wall around the wealth of the affluent by making everyone else pay. If you’re a member of the 99%, the “reformers” are coming for you.

===========================================================

** (click here to see original chart and explanation)

In fiscal year 2023, the federal government is estimated to spend $6.3 trillion, amounting to 24.2 percent of the nation’s gross domestic product (GDP). Of that $6.3 trillion, over $4.8 trillion is estimated to be financed by federal revenues. The remaining amount will be financed by net borrowing.

Sources of Federal Revenue so far in FY 2024, individual income taxes have accounted for 51% of total revenue while Social Security and Medicare taxes made up another 35%. Government revenue also comes from payments to federal agencies like the U.S. Department of the Interior.

Social Security and Medicare Taxes

Unlike personal income taxes, which support a variety of programs, these taxes are only used to fund Social Security and Medicare. These funds are collected from your paycheck, and in most cases, matched by your employer, and then divided into separate trust funds that support each of those programs.

Social Security has two trust fund accounts: the Old Age and Survivors Insurance Trust Fund (OASI) and the Disability Trust Fund (DI). The funds in these accounts are responsible for providing workers and their families with retirement, disability, and survivor’s insurance benefits.

Medicare also has two accounts: the Hospital Insurance Trust Fund (HI), also known as Medicare Part A, and the Supplementary Medicare Insurance Trust Fund (SMI). These funds pay for hospital, home health, skilled nursing, and hospice care for the elderly and disabled.

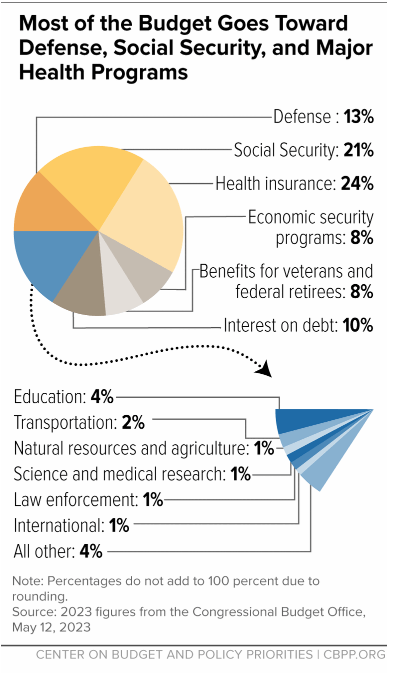

As the chart below shows, three major areas of spending make up the majority of the budget:

- Social Security: In 2023, 21 percent of the budget, or $1.4 trillion, will be paid for Social Security, which will provide monthly retirement benefits averaging $1,836 to 48.6 million retired workers. Social Security also expects to provide benefits to 2.7 million spouses and children of retired workers, 5.9 million surviving children and spouses of deceased workers, and 8.8 million disabled workers and their eligible dependents.

- Health insurance: Four health insurance programs — Medicare, Medicaid, the Children’s Health Insurance Program (CHIP), and Affordable Care Act (ACA) marketplace health insurance subsidies — together account for 24 percent of the budget in 2023, or $1.5 trillion. One-half of this amount, or $828 billion, goes to Medicare, which provides health coverage to around 66 million people who are aged 65 and older or have disabilities. The rest of this category funds the federal costs of Medicaid, CHIP, and ACA subsidy and marketplace costs. (Both Medicaid and CHIP require states to pay some of their total costs.)In May 2023, Medicaid and CHIP provided health care or long-term care to about 94 million low-income children, parents, older adults, and people with disabilities. That is elevated from 71 million people prior to the pandemic due to a temporary pandemic-related coverage protection that expired in April 2023. Enrollment is projected to decline by about 15 million by October 2024, but projections are highly uncertain. In February 2023, 14.3 million of the 15.7 million people estimated to be enrolled in health insurance through ACA marketplaces received subsidies that lower their premiums and out-of-pocket costs, at an estimated cost of about $88 billion.

- Defense: Another 13 percent of the budget, or $806 billion, will be paid for national defense activities. About 95 percent of the spending in this category reflects the underlying costs of the Defense Department, largely for operations and maintenance; military personnel; procurement of weapons; and research, development, testing, and evaluation.

Three other categories together account for one-quarter of spending:

- Economic security programs: About 8 percent (or $522 billion) of the federal budget in 2023 supports programs that provide aid (other than health insurance or Social Security benefits) to individuals and families facing hardship. Economic security programs include: the refundable portions of the Earned Income Tax Credit and Child Tax Credit, which assist low- and moderate-income working families; programs that provide cash payments to eligible individuals or households, including unemployment insurance and Supplemental Security Income for low-income people who are over age 65 or disabled; various forms of in-kind assistance for low-income people, including the Supplemental Nutrition Assistance Program (formerly known as food stamps), school meals, low-income housing assistance, child care assistance, and help meeting home energy bills; and other programs such as those that aid abused or neglected children.Such programs keep millions of people above the poverty line each year. COVID relief and other government assistance lifted a record 53 million people above the poverty line in the pandemic, including a record 12 million children in 2021, a CBPP analysis found using Census data and the Supplemental Poverty Measure (SPM), which accounts for government benefits and taxes. Not counting any government benefits and tax policies, 23.8 percent of the U.S. population would have had incomes below the poverty line in 2021; this was triple the poverty rate of 7.8 percent using the SPM. These programs reduced the extent of poverty for millions more, even when not bringing them above the poverty line.With the expiration of COVID relief, poverty rose substantially in 2022, despite strong labor market gains that helped hold inflation-adjusted pre-tax cash incomes steady for the lowest-income one-fifth of households.While racial inequities continue to exist, government economic security programs noticeably reduce racial and ethnic differences.

- Benefits for veterans and federal retirees: In 2023, about 8 percent of the budget provides benefits to veterans and former career employees of the federal government, both civilian and military, totaling $477 billion. About nine-tenths of the benefits available to all veterans are either disability payments or medical care, which is often specialized to deal with the unusual conditions that military service may impose. There are currently more than 18.5 million veterans of U.S. military service, of whom 2.2 million are retired career military who have earned monthly retiree pensions or survivor benefits. There are also 2.8 million federal civil service retirees.

- Interest on debt: The federal government must make regular interest payments on the money it borrowed to finance past deficits — that is, on the net federal debt, which is projected to reach $23.8 trillion by the end of fiscal year 2023. This year, these interest payments will claim $663 billion, or about 10 percent of the budget.

As the chart above shows, the remaining federal spending — the blue slice of the pie — supports a variety of other public services. A very small slice — 1 percent of the budget — goes to programs that operate internationally, including programs providing humanitarian aid and maintaining U.S. embassies and consulates. The rest includes investing in education; investing in basic infrastructure such as roads, bridges, and airports; maintaining natural resources, farms, and the environment; investing in scientific and medical research; enforcing the nation’s laws to promote justice; and other basic duties of the federal government.

My cmnt: I’ve left in the ending paragraph (below) as it misleadingly tries to act as if the opposition to federal spending is that it doesn’t provide clear benefits. Federal spending clearly provides benefits to someone, whether or not that someone actually is the supposed beneficiary of said spending is another matter. Certainly all the hundred of thousands of people who make a good living working in these various government programs benefit greatly from them.

My cmnt: But the real issue with government spending is whether or not it accomplishes its stated goals. Much of the time, under objective evaluation, it does not. Secondly, almost all the time top-down, planned economies and government programs fail miserably, are incredibly wasteful and mostly simply guarantee more democrat voters. The issue is whether the private sector, driven by competition and the need to be efficient, would do a better job of delivering the goods and services – at far less cost, with the unforeseen innovations that arise from bottom-up, invisible-hand mechanisms, than the stagnant, self-serving swamp will.

My cmnt: Time after time we see in the real world of results oriented endeavors that individual people will allocate their hard-earned dollars better and in more satisfying ways to the person spending the dollars than a bureaucrat ever will.

My cmnt: The union-driven public school teachers is a perfect example. The failure of public schools to actually educate students in something useful and valuable to making a living is too well documented to belabor here. The entire, government (i.e., taxpayer) funded public school system mainly guarantees that teachers, regardless of results or outcomes, will be well taken care of and students be damned. The actual purpose of most modern unions is to increase employment in the union while the quality or the cost of the product is only an after thought if actually thought about at all.

While critics often decry “government spending,” it is important to look beyond the rhetoric and determine whether the actual public services and investments that government provides are valuable. Federal revenues are used to pay for these services and investments. Consequently, when thinking about the costs that taxes impose, it is essential to balance those costs against the benefits the nation receives from the expenditure of those funds.

One thought on “Social Security is perfectly healthy, but there’s one easy way to improve it”